Here at ILT we buy into the notion that customer support is the best way to market our company. Our current clients are partners, so why not solidify that relationship on an ongoing basis? It turns out that this line of thinking is consistent with the idea that it costs 5 times more to recruit a new customer than it does to retain one (Forbes: article).

Banks are in the business of growing their customer base, so why not start is with indirect loans. These indirect loan customers are more than just leads, they’re already using a bank product. As an added bonus you’ll be gathering data on this set of leads as they continue to make payments. The key is to convert this existing indirect lead into a full fledged customer during that payment life-cycle.

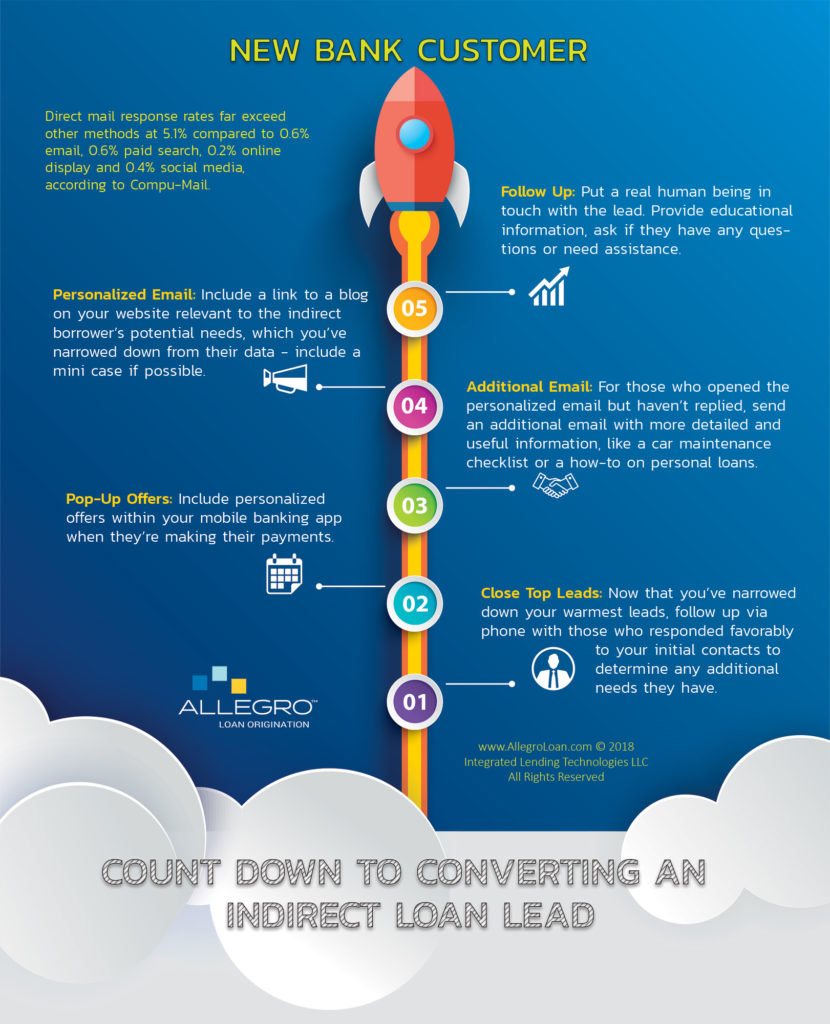

To that end we’ve created an infographic that illustrates the steps we take to retain customers that are already connected to our company or products. These steps can be applied to increase a bank’s customer base. Below is our protocol applied to indirect bank leads.

Download “Count Down To Converting Indirect Leads” below:

A Loan Origination Inforgraphic