Allegro is now nCino – Learn more

“Integrated Lending Technologies, the company that pioneered the industry’s widely popular DILLS™ and PILS™ lending systems introduces their newest loan origination platform…”

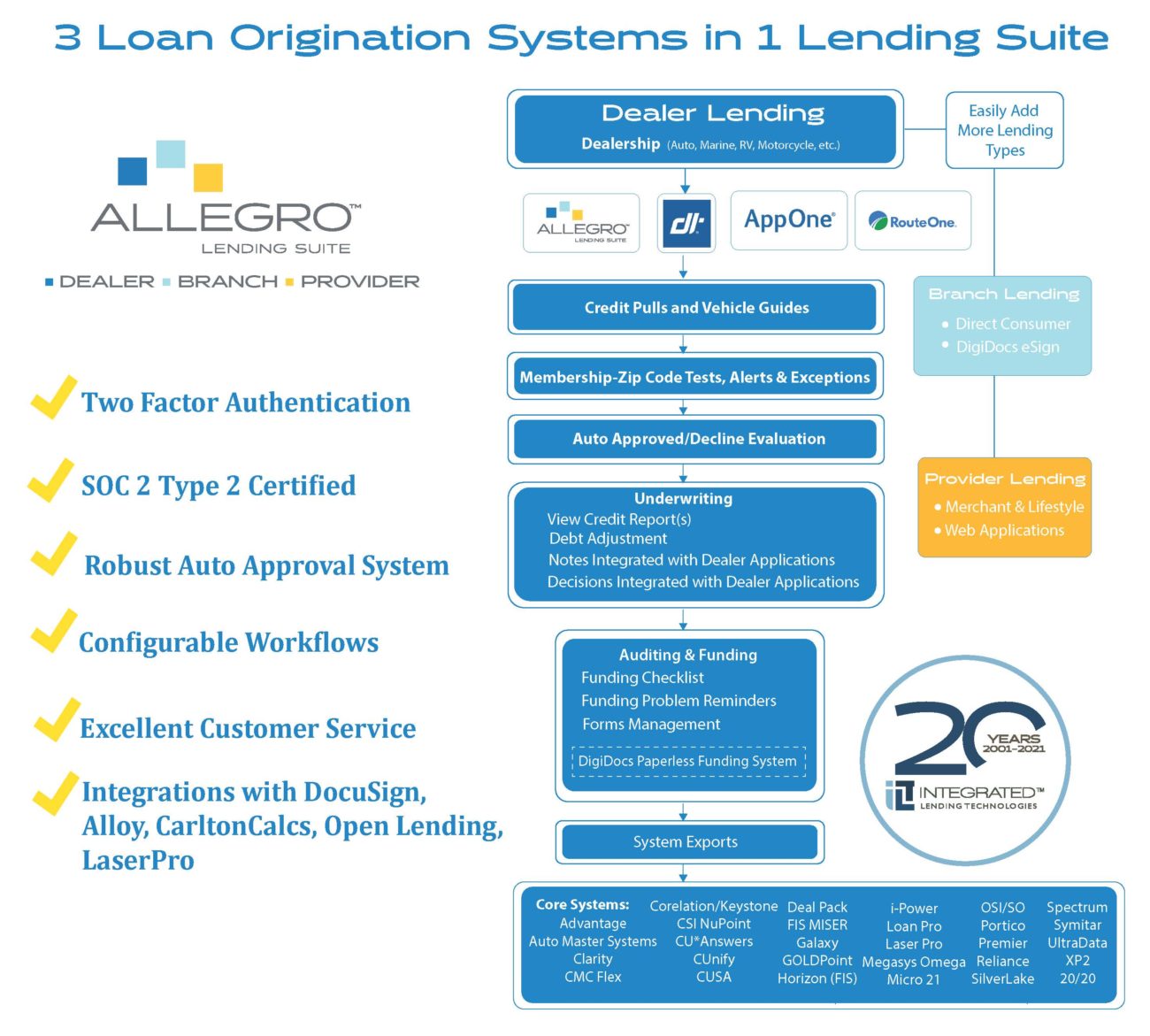

Allegro™ Lending Suite Loan Origination Software

The Allegro Lending Suite is an industry-leading consumer loan origination system that streamlines your direct and indirect lending operations from a single, cloud based platform. Designed to help you scale your lending programs with efficiency and informed data metrics, Allegro connects proven, best-in-class technology with your business strategy to help you maximize your competitive edge.

Allegro features are available in three modules: Dealer, Branch, and Provider; each tailored to the requirements of specific loan origination programs. The modules are fully integrated for a seamless, intuitive user experience that lets your team focus on what matters most: making deals

Allegro™ Conductor – A Powerful Partnership with LSI

ILT Announces Integration with DocuSign as Enhancement to its Allegro™ Lending Suite

Four Must-Haves In Loan Origination Software Infographic

Conductor Simplifies Managing Multiple Indirect Programs

Allegro™ Software Features And Highlights

The Dealer module provides a feature-rich environment supporting indirect lending. Document management, reporting, and data analytics are tailored to reduce bottlenecks and missed steps in the deal cycle.

Following is a list of some of the features of the Allegro Dealer Module:

• Administrative login controls who can access underwriting and funding features based on their role in your organization.

• DealerTrack, AppOne, RouteOne and other dealer system integrations

• Versatile online dealer application

• Credit reports from the three major bureaus, including a wide selection of scoring models

• Fully customizable automated approval system

• Automated and Manual rate matrices

• Dealer scorecards to precisely manage business and relationships

• Comprehensive Alerts System

• Funding tools, including ACH funding to dealers

• TruDecision and Scienaptic AI risk calculators

• Selecting lending cores and automated data exports

• Digital documents and funding using DigiDocs™, our proprietary document solution

• Comprehensive suite of configurable reports to analyze applications and application source performance, bookings, cross-selling, and dealer performance.

• Customized forms pre-filled for printing at dealership

• Welcome letters tailored to fit your business operations

• Document packet auditing tools

• Interactive DTI and LTV analyses

• Adverse action and credit score disclosure notice

• Team dashboards track workflow activities, applications, and funding totals at a glance

• Audit trail features ensure your institution can trace who’s working a deal

• Real-time dealer communication speeds processes and track messages with the deal in question

• Internal notes system keeps your team aware of hand-offs and deal details

• Comprehensive alerts system helps your team identify potential problems as they process deals.

• Configurable email settings notify your team when deals need attention.

The Branch module supports your organization’s direct lending program with sophisticated functionality that simplify underwriting, funding, and doc prep. Automation features and expansive setup configuration options helps you tailor the solution for a hand-in-glove fit with your lending operations.

Following is a list of some of the features of the Allegro™ Branch Module:

• Administrative login controls who can access underwriting and funding features based on their role in your organization

• Automated and manual rate matrices

• Credit reports from the three major bureaus, including a wide selection of scoring models

• Credit reports from the three major bureaus, including many scoring models

• Fully customizable automated approval system

• Automated and manual rate matrices

• Funding tools, including ACH funding to banks

• TruDecision and Scienaptic AI risk calculators

• Selecting lending cores and automated data exports

• Digital documents and funding using DigiDocs™, our proprietary document solution

• Adverse Action and credit score disclosure notices

• Comprehensive suite of configurable reports to analyze applications and application source performance, bookings, cross-selling, and dealer performance.

• Document packet auditing tools

• Interactive DTI and LTV analyses

• Welcome letters tailored to fit your business operations

• Team dashboards track workflow activities, applications, and funding totals at a glance

• Audit trail features ensure your institution can trace who’s working a deal

• Real-time dealer communication speeds processes and track messages with the deal in question

• Internal notes system keeps your team aware of hand-offs and deal details

• Comprehensive alerts system helps your team identify potential problems as they process deals.

• Configurable email settings notify your team when deals need attention.

The Provider module offers features curated for loans financing the purchase of retail consumer goods and services and can take applications from a merchant or provider website. It’s built to deliver maximum versatility while offering the robust automation and data analytics that manage your institution’s risk.

Following is a list of some of the features of the Allegro™ Provider Module:

• Administrative login controls who can access underwriting and funding features based on their role in your organization.

• Consumer applications available from the merchant’s or provider’s website

• Automated and manual rate matrices

• Credit reports from the three major bureaus, including a wide selection of scoring models

• Fully customizable automated approval system

• Automated and manual rate matrices

• Funding tools, including ACH funding to banks

• TruDecision and Scienaptic AI risk calculators

• Selecting lending cores and automated data exports

• Digital documents and funding using DigiDocs™, our proprietary document solution

• Adverse action and credit score disclosure notice

• Welcome letters tailored to fit your business operations

• Document packet auditing and funding tools

• Interactive DTI and LTV analyses

• Comprehensive suite of configurable reports to analyze applications and application source performance, bookings, cross-selling, and dealer performance.

• Team dashboards track workflow activities, applications, and funding totals at a glance

• Audit trail features ensure your institution can trace who’s working a deal

• Real-time dealer communication speeds processes and track messages with the deal in question

• Internal notes system keeps your team aware of hand-offs and deal details

• Comprehensive alerts system helps your team identify potential problems as they process deals

• Configurable email settings notify your team when deals need attention.

“Thank you for Allegro. I see so many great things with it, and we love the partnership and the great team you have “

Bill Costan // SVP Lending and Branch Operations Timberland Federal Credit Union