Converting members who come in through partnerships with dealerships or other service providers has been the bane of credit unions’ existence. Indirect can provide tremendous growth, but if they’re not using more products they won’t be a profitable member to the credit union. Why do credit unions have such difficulty converting them? Think about the consumer’s journey. They want a car. They go to the dealership for a car. They need a loan to get the car. They probably know nothing about your credit union – only that they received a loan at the dealership for a car they wanted.

Credit unions have used indirect as a springboard for growth in the years since the economic crisis. Between 2012 and 2017, credit union auto loans grew 14.8%, nearly double the banks, according to a report in CU Journal. That growth was primarily driven by indirect auto lending, which is still forecast to grow as direct loans slow.

As much as we love indirect auto lending here, credit unions must be a source of more than just car loans to be safe and profitable. CU Journal’s article continued on to point out that as credit unions added these indirect members, their share of member wallet declined three percentage points. Bain research shows that a consumer’s primary financial institution receives 64% of their financial services business, which is why it’s so critical to convert these members to using multiple products.

Download Our Converting Indirect Members Infographic:

The good news, according to CU Journal, is that 88% who use their credit union as their PFI intend to put most, if not all, of their business in their credit union. But they are also seeing a lot of competitive offers. Just one of every four auto loan offers a consumer receives is from their credit union, and the gap widens significantly with consumer loans and student loans. Credit unions are getting left behind in their email marketing, too, with 53% of bank marketing delivered via email versus 38% of credit unions.

Before your credit union even markets to your members coming through indirect, review your products and services to ensure they are as frictionless as possible. Next, get to know these members through the data you already have about them. Have their credit scores recently increased or decreased? Did they move recently? Life events, such as moving for a new job or having a baby, provide great information for targeting specific offers. Finally, marketing messaging has to be on point. Don’t focus on the features of your products and services but show them how they will feel banking with you. Millennials appreciate a company that aligns with their values and Gen X wants security while boomers want vitality and new adventures in life. Study how your institution can display that need and drive the emotional response in alignment with your business purposes. Keep in mind, refinancing existing loans these members have elsewhere are your low-hanging fruit. Additionally, a report from TeleVox on converting indirect members reported credit unions had most success converting indirect members with a line of credit (28% conversion), credit cards (17%) or auto refinancing (15%).

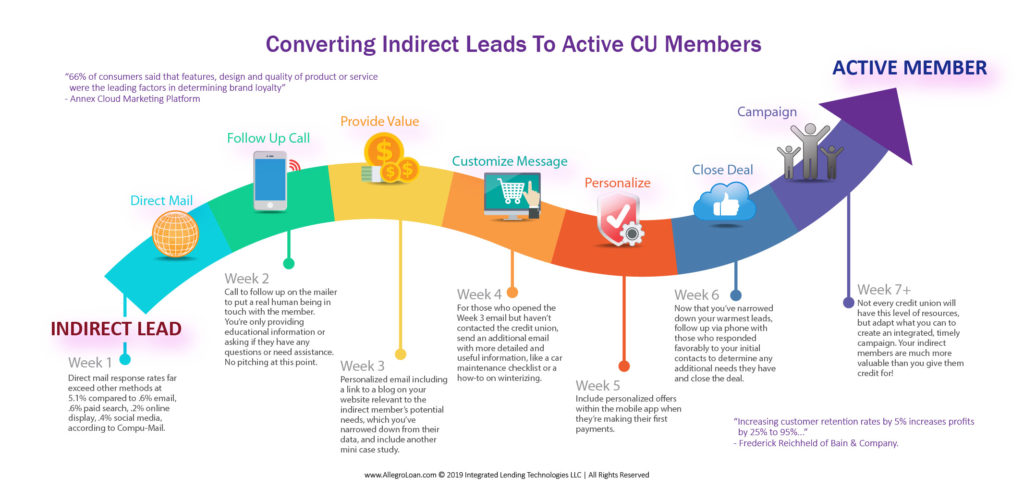

Timely and integrated campaigns are most effective. The first 90 days is critical to cross-sell opportunities, according to a report on converting indirect members from TeleVox. The report recommends reaching out 3-4 times during that period, but we might go even further. We at Allegro Lending Suite would recommend a drip marketing campaign to help narrow down your contacts to the warmest leads. An ideal program might look like:

Week 1: Mailer with new member package about how the credit union helps individuals and the community. Direct mail response rates far exceed other methods at 5.1% compared to .6% email, .6% paid search, .2% online display, .4% social media, according to Compu-Mail. Include a mini case study, like a simple statement that on average members save/earn $X per year refinancing their [type of product] with us. Then hit them with a picture of a specific member (with permissions, of course) and their story in a couple of sentences.

Week 2: Call to follow up on the mailer to put a real human being in touch with the member. You’re only providing educational information or asking if they have any questions or need assistance. No pitching at this point.

Week 3: Personalized email including a link to a blog on your website relevant to the indirect member’s potential needs, which you’ve narrowed down from their data, and include another mini case study. Add an unobtrusive product offer and contact info to a specific person at the credit union.

Week 4: For those who opened the Week 3 email but haven’t contacted the credit union, send an additional email with more detailed and useful information, like a car maintenance checklist or a how-to on winterizing their new vehicle.

Week 4-6: Include personalized offers within the mobile app when they’re making their first payments.

Week 4+: Now that you’ve narrowed down your warmest leads, follow up via phone with those who responded favorably to your initial contacts to determine any additional needs they have and close the deal.

As I said at the beginning, this is an ideal scenario. Not every credit union will have this level of resources, but adapt what you can to create an integrated, timely campaign. Your indirect members are much more valuable than you give them credit for!