“Increasing customer retention rates by 5% increases profits by 25% to 95%,” according to research done by Frederick Reichheld of Bain & Company. Sure this statistic is normally used for the retail market, but it does apply to indirect CU members. If we are willing to perceive indirect CU members as existing customers rather than new leads then this statistic applies. It’s not easy to convert indirect members, but it is valuable.

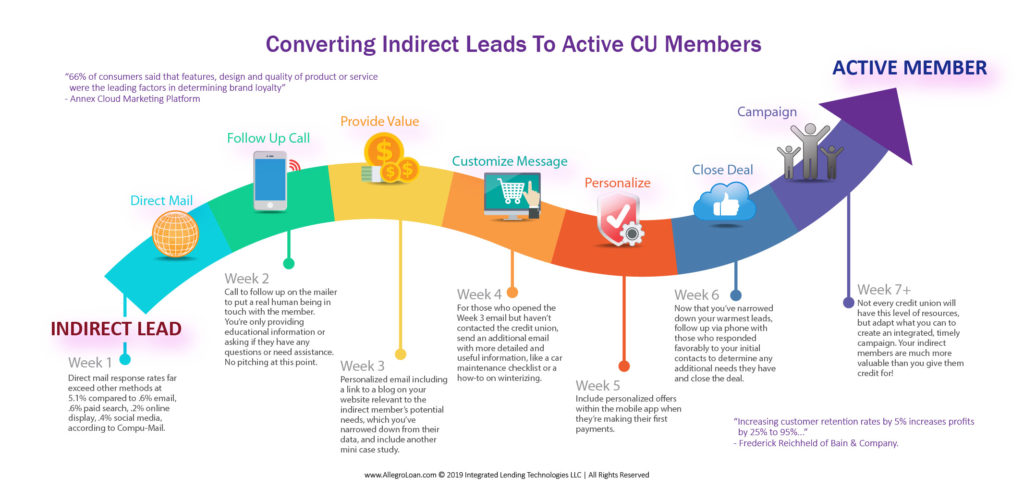

“We have been doing this a long time. And if we were cooks, I’d say we have tried every recipe in the world to make new indirect members use the credit union for more than just a loan,” Laffoon told CUToday.info. Taking many of those recipes into account we’ve created an infographic that details steps to this conversion week by week. Sure it may take several weeks, but if applied to a long list of indirect members, you’ll see positive results. Indirect auto lending is a growing market for most credit unions, so it stands to reason that this pool of leads is a robust target for active member conversion.

“Auto lending continues to be a strong driver of growth and revenue for credit unions early in 2018. CUNA Mutual predicted 9.5% overall loan growth in 2018, with auto loans leading the way. First quarter auto lending data shows that credit unions are not only on pace to meet 2018 forecasts, they’re shifting into high gear.”

– cutimes.com/2018/05/25/credit-union-auto-lending-revs-up

Converting Indirect Members Infographic – 2019 Integrated Lending Technologies